You can use time tracking software to automate calculating work hours payments overtime to save your time and so on. Divide your monthly salary by 26 to get your daily rate.

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Add 8 hours to make up the 2 days wages.

. Overtime Rest-day x2 as the employee is already receiving his normal holiday pay through his monthly salary so only the additional x2 rate needs to be added. Normal working day 15 Basic pay 26 days X 15 X hour of works. 100 x 5 500.

The law on overtime. For overtime work your employer must pay you at least 15 times the hourly basic rate of pay. Even though the pay rate is 1 ½ time the hourly rate of employee pay some employers found it rather economical to ask employees to work overtime than hire a new employee.

Daily salary An employee works normal working hours of 8 hoursa day earning RM50on a daily basis. For employees whose salary exceed RM2000 a month the hours of work and overtime work depend on the terms agreed under their employment contracts. Hourly rate of pay means the daily or ordinary rate of pay divided by the normal hours of work as agreed between the employers and employees.

The same employees hourly rate of pay would be RM1250 RM100 8 hours RM1250---In the event that an employee was asked to work on a public holiday during hisher normal working hours. If an employee is eligible for overtime pay multiply all hours worked over 40 hours per week or 8 hours per day by 15 or 20 times their base hourly pay rate. So when an employee works 8 hours a day for a monthly salary of RM2600 heshe will have an ordinary rate of pay of RM100 Monthly salary 26 RM2600 26 RM100.

Employees are entitled to overtime pay. - 05 x ordinary rate of pay half-days pay More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay In excess of eight 8 hours-20 x hourly rate x number of hours in excess of 8 hours. Divide the employees daily salary by the number of normal working hours per day.

This means an average of about 4 hours in 1 day. The employers should still remember that they cannot require any employee under any situations to work longer than 12 hours in one day. However the Act only covers a number of select employee categories in Malaysia.

The Employment Limitation of Overtime Work Regulations 1980 provides that the limit of overtime work shall be a total of 104 hours in any 1 month. Chia Lee Associates. How to Perform Salary Calculator Malaysia.

Employees engaged in the operation or maintenance of mechanically propelled vehicle. If you plan to offer your employees paid vacations make sure to let your employees know. Overtime pay is money paid to an employee who works over 48 hours per week averaged over a period of 17 weeks.

What is overtime pay. The rules for normal working hours as laid down by the EA 1995 include. An employee weekly rate of pay is 6.

The calculation of overtime in Malaysia is rather simple than the working and non-working days. Employees who are engaged in manual labour regardless of salary. Regular timerate overtimerate15 regular timerate overtimerate15 According to this calculation overtime compensation is 15 times the regular rate of pay.

Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate. Working on Off-day 20 Basic pay 26 days X 20 X hour of works. Working on Public Holiday.

Heshe will have an ordinary rate of pay of RM100 RM2600 26 RM100. Despite the pay rate shall be 1 ½ times the hourly rate of pay of employees some employers found it rather economical to required employees to. In one working day employees can work up to 8 hours if it is a six-day workweek.

Overtime hours 3 hours Overtime pay Hourly rate X Overtime hours X Overtime rate RM 8 X 3 X 15 RM 36. Overtime on Normal Working Day. An employee monthly rate of pay is always fixed to 26.

The overtime rate shall be 15 x Hourly Rate x Number of Hours Worked b. The protection under the Employment Act only applies to these categories of employees lets call them EA Employees. However you must be at least eighteen years old.

RM50 8 hours. Overtime on rest day Employee who works overtime on rest day not exceeding half hisher normal hours of work. Employees who earn monthly wages of RM2000 or less.

If it is a five-day workweek employees can work a maximum of nine. Overtime in Florida is equal to 15. For example an employee who works 8 hours a day for a monthly salary of RM260000.

Paying employee wages late. In PayrollPanda use the preset overtime item. Workers can work up to 48 hours per week for a maximum of three weeks.

Compute your ordinary rate of pay or daily rate. Overtime Pay Non-Working Days Overtime Hourly Rate Overtime. Salary Formula as follows.

Calculate your overtime pay. Basic Allowance Incentive 26 days 8 hours. Florida has no set hourly limit.

Basic pay 26 days X 30 X hour of works. One day this employee works. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours.

How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. If you work more than 40 hours a week as an hourly employee you are entitled to overtime pay. Hourly rate of pay When an employee works 8 hours a day for a monthly salary of RM2600 the same employees hourly rate of pay would be RM1250.

RM6250 3 RM18750. In excess of eight 8 hours-. The pay for overtime work shall be at a rate of not less than 1 ½ time of the employee hourly rate of pay.

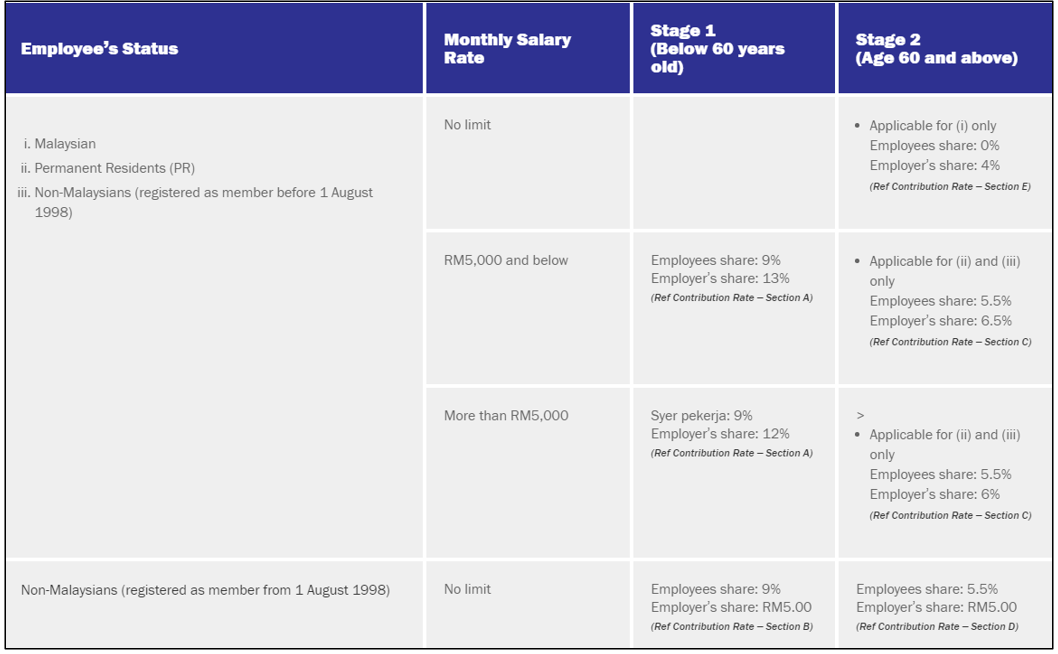

Employees whose monthly salary does not exceed RM2000. An employer is not obligated to pay employees who work overtime unless its in their contract in the UK. Multiply your hourly rate by the number of overtime hours and overtime rate.

However if they work overtime the average pay rate per hour should not fall below the national minimum wage. For employees with salary not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955 the laws in respect are spelled out in the Employment Act 1955. More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay iii.

The right-hand side of the calculation overtimerate15 will be zero if the overtime is nil and the employee will get simply the standard compensation. Not exceeding half his normal hours of work-05 x ordinary rate of pay half-days pay ii. 500 150 650 total key takeaways.

According to the Employment Act 1955 employers are required to payout monthly wages on the seventh day of the following month or earlier. For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate. There are only two conditions to cater to.

Knowing Your Labour Laws In The Czech Republic Tmf Group

Your Step By Step Correct Guide To Calculating Overtime Pay

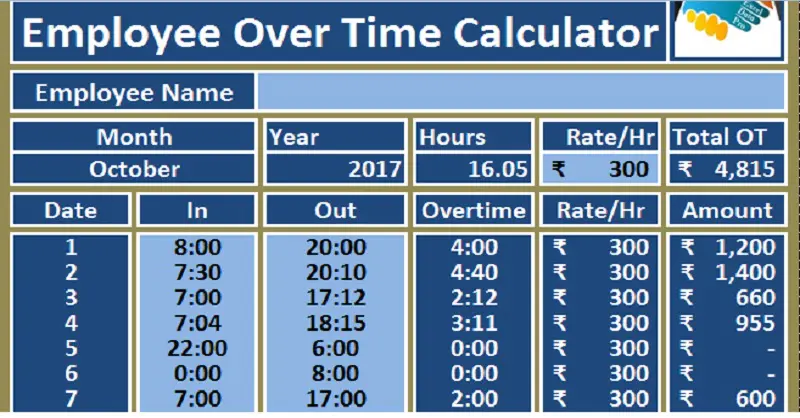

Download Employee Overtime Calculator Excel Template Exceldatapro

Excel Timesheet Calculator Template For 2022 Free Download

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Quickly Calculate The Overtime And Payment In Excel

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Calculation Dna Hr Capital Sdn Bhd

Everything You Need To Know About Running Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime For Salary Employees In Malaysia Madalynngwf

Excel Timesheet Calculator Template For 2022 Free Download

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula Basic Overtime Calculation Formula

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Overtime Calculator For Payroll Malaysia Smart Touch Technology